Why Are Virtual Banking Assistants Essential ?

Baking is a competitive industry, where every day comes with the changing dynamics. Today, you can be on the top, and your competitors will take that position the next day if you want to stay ahead of the competition. Then, you need to hire the virtual banking assistants. They will help you build a strong relationship with your clientele.

A virtual banking assistant is a remote professional who provides personalized assistance to customers by handling financial inquiries, guiding them through banking processes, and offering tailored financial advice. Unlike AI-driven virtual assistants, They bring a human touch, emotional intelligence, and adaptability to customer interactions. They can work across multiple platforms, including phone, email, and live chat, ensuring seamless service delivery.

The Role of Virtual Banking Assistant

Human virtual assistants provide customer support, handle routine banking tasks, and assist with complex financial inquiries. They can:

- Offer personalised financial advice based on a customer’s unique needs.

- Assist with account management, including balance inquiries, fund transfers, and transaction history reviews.

- Guide loan applications, investment plans, and credit card management.

- Help customers navigate banking portals and mobile applications.

- Resolve billing issues and disputes efficiently.

- Delivering Personalized Banking Experiences

Customers appreciate banking services that cater to their specific financial needs.

These professionals analyse customer data and past interactions to provide tailored recommendations on budgeting, investment opportunities, insurance, and financial planning.

Their ability to engage in meaningful conversations fosters trust and strengthens customer relationships.

Creating a Customized Banking Experience

The traditional one-size-fits-all approach to banking services is no longer sufficient. With human virtual assistants, banks can create a highly customized experience by:

- Offering real-time, one-on-one consultations tailored to customer preferences.

- Customers can set personalized alerts for transactions, bill payments, and financial milestones.

- Analyzing spending patterns to offer exclusive discounts, savings plans, and loan advice.

Virtual Assistants For Improving Customer Support

Banking virtual assistants streamline operations by reducing customer service wait times and improving resolution rates. Unlike automated systems, they can handle complex and emotionally sensitive issues with empathy and expertise. Some key benefits include:

- Quick and Efficient Issue Resolution – Customers can get immediate answers to their queries without navigating automated menus.

- Proactive Support – Anticipating customer needs by analyzing past interactions and providing proactive assistance.

- Cross-Platform Availability – Communicate through phone, email, and live chat, ensuring accessibility for all customers.

Banking Customers' Expectations and Support Interaction

Most banking customers prefer human assistance over AI-driven solutions for complex financial matters. While AI can handle routine inquiries, human virtual assistants excel in situations requiring critical thinking, problem-solving, and emotional intelligence. They can offer personalized support that builds stronger customer relationships and enhances brand loyalty.

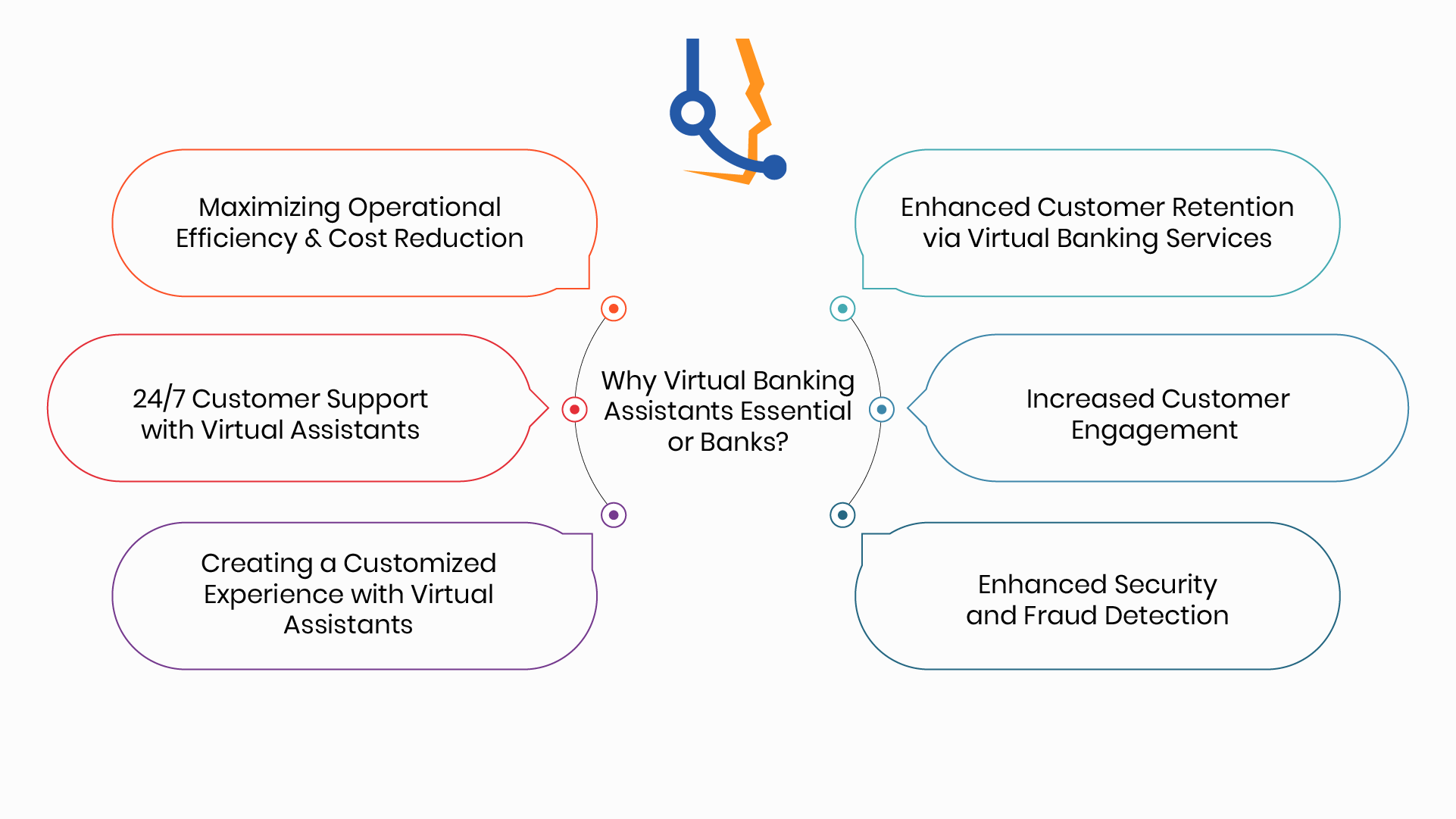

6 Reasons Why Virtual Banking Assistants Essential for Banks

With the shift in the global sector regarding globalisation, banks were among the few industries to provide their client with online access to capital and transaction solutions. Now, the banking sector needs to focus on customising the support solutions for the clients. Once they hire the virtual banking assistant, many operations, such as checking balances, insurance, and processing transactions, will be handled professionally.

With the shift in the global sector regarding globalisation, banks were among the few industries to provide their client with online access to capital and transaction solutions. Now, the banking sector needs to focus on customising the support solutions for the clients. Once they hire the virtual banking assistant, many operations, such as checking balances, insurance, and processing transactions, will be handled professionally. Maximizing Operational Efficiency & Cost Reduction

If you choose to introduce the virtual banking assistant for your clients, from the

Balance inquiries, transaction processing, and account management, every task will be handled efficiently. These tasks need different hirings and teams, along with the process details. For data entry, a virtual assistant for banking will help you speed up this process.

Even during after-hours banking, customers will get access towards a personal will be available for the clients to communicate. So, if your customers are not in the same time zone, this feature of hiring the baking virtual assistant will help you stay connected.

The best example is that if your customers are working during the day but want to communicate about their banking issues after working hours, if you hire teams for different shifts, a double task of training them costs money and effort will be there. If you choose a virtual assistant team for the financial sector, they will cut costs and ensure their presence even after hours.

Many banks reduce costs by outsourcing customer service operations to regions with lower labour costs. According to the survey, outsourcing can cut operational expenses by up to 30-50% while maintaining high service quality.

This will not just help reduce costs but will also assist in the appropriate allocation of resources.

Enhanced Customer Retention via Virtual Banking Services

If banks start to integrate AI along with virtual banking assistant, they can form a very powerful source of attraction for their client. This will also help them stay ahead of their competition.

On the one hand, banking applications provide customers with the best tools for managing their transactions, and the virtual assistant option on those apps can be the game changer. The chat with the virtual assistant can help them achieve their motive of logging into the app.

Especially for the members who need assistance due to ageing or the knowledge factor.

This will increase customer satisfaction when they are not bound to travel to the branch to get the information, and all the baking processes will be done via online assistance.

24/7 Customer Support with Virtual Assistants

In today’s fast-paced digital era, providing prompt customer service is crucial to maintaining customer satisfaction. Virtual assistants ensure that banking support services are available 24/7, allowing customers to receive immediate assistance whenever needed.

Imagine encountering an issue while making a transaction late at night. With a virtual assistant, you can instantly get guidance and resolution without having to wait for business hours. Virtual assistants are available via email, toll-free phone calls, live chat, and an online queue system, reducing stress and improving customer experience.

Increased Customer Engagement

Virtual assistants can enhance customer engagement by introducing gamification and personalized recommendations. They make banking more interactive by integrating daily challenges, rewards, and leaderboards that encourage financial discipline.

For example, a virtual assistant can track savings goals and reward customers for meeting their targets. Customers who consistently save money or manage their finances responsibly can earn points, which may be redeemed for discounts or cashback offers. This approach not only encourages financial responsibility but also fosters customer loyalty.

Additionally, virtual assistants provide personalized financial advice based on customer spending patterns. They analyze data to offer recommendations related to investment opportunities, budgeting strategies, insurance plans, and credit card management, ensuring that each customer receives tailored financial guidance.

Creating a Customized Experience with Virtual Assistants

Banking is no longer a one-size-fits-all service. Virtual assistants enhance the user experience by allowing customers to personalize their banking interactions.

With a virtual assistant, customers can customize their user interface by choosing colour themes, layouts, and dashboard widgets. They can also set personalized push notifications for transaction alerts, bill reminders, and spending insights. By analyzing customer behaviour, virtual assistants provide timely discounts, loan recommendations, and financial planning advice that align with individual needs.

Enhanced Security and Fraud Detection

Virtual assistants play a crucial role in improving banking security by monitoring transactions in real-time and detecting suspicious activities. They can instantly alert customers about potential fraud, unauthorized transactions, or unusual spending behaviour, helping prevent financial losses. By integrating with fraud detection systems, virtual assistants contribute to a safer banking experience and enhance trust between banks and their customers.

Enhancing Personalization in Banking With Remote Assistants

Enhancing Personalization in Banking With Remote Assistants

Banks can improve the user experience with virtual assistants, which can provide compassionate support to clients. This will result in the following:

Optimizing Contact Center Efficiency

By leveraging customer data and behavioural insights, human banking assistants can tailor interactions to meet individual needs. Understanding customer history allows call centre representatives to provide more efficient, personalized support and streamline transactions.

Designing Intelligent Customer Support Journeys

Human assistants can track and analyze customer interactions to refine service strategies. Observing how customers navigate processes like account openings enables banks to enhance procedures and improve overall user experience.

Delivering Immediate, Personalized Support

With access to customer history and preferences, human banking assistants can provide fast, context-aware service across multiple communication channels. Their ability to understand nuances and emotions ensures a higher level of customer satisfaction and issue resolution.

By combining human expertise with data-driven insights, financial institutions can create more meaningful and effective customer interactions.

The Future of Banking with Virtual Assistants

As the banking industry continues to evolve, the role of virtual assistants will become even more critical. Banks that incorporate VAs into their customer service strategy will benefit from increased customer loyalty, improved service efficiency, and a more personalized banking experience. By combining human expertise with digital convenience, financial institutions can achieve a perfect balance between technology and human interaction.

Final Thoughts

In an era where customer expectations are at an all-time high, banks must adapt by providing top-notch, personalized services. Virtual assistants bridge the gap between technology and customer care, ensuring that clients receive the support they need with a human touch. If you want to stay ahead in the competitive banking industry, investing in VAs is a strategic move that can significantly enhance your customer service and overall banking experience.

Frequently Asked Questions (FAQs)

1. What tasks can a virtual assistant perform in banking?

Virtual assistants can assist with account management, transaction support, customer inquiries, loan applications, and personalized financial guidance.

2. How does a virtual assistant improve banking customer service?

By providing real-time assistance, resolving issues efficiently, and offering personalized recommendations based on customer data.

3. Can virtual assistants handle sensitive financial information?

Yes, virtual assistants follow strict security protocols and compliance guidelines to ensure data privacy and protection.

4. How do virtual assistants differ from AI chatbots?

Unlike AI chatbots, virtual assistants provide a human touch, and emotional intelligence and can handle complex queries that require critical thinking.

5. Are virtual assistants available 24/7?

Depending on the banking institution, virtual assistants may be available around the clock to assist customers anytime.

6. What are the cost benefits of hiring virtual assistants for banks?

Banks can reduce operational costs by outsourcing customer service tasks to virtual assistants while maintaining service quality.

7. How can virtual assistants help in financial planning?

Virtual assistants can offer budgeting advice, investment options, and credit management tips by analyzing customer spending habits and financial goals.

Leave A Reply

Your email address will not be published. Required fields are marked *